Every organization benefits from sound financial guidance, and every Financial Advisor resume worthy of a hiring manager’s consideration must excel on several fronts.

Financial Advisors understand that precision, strategic thinking, and client trust are essential for success, and the same principles apply when crafting your resume. Your resume is your first impression—make sure it clearly reflects your expertise and professionalism.

Resume guide for a Financial Advisor resume

Fitly here to help. Our resume builder and proven resume examples across hundreds of careers will give you the edge to advance in your pursuit of a top Financial Advisor position. This resume guide and sample will cover key areas such as:

- Selecting the best resume format for Financial Advisors

- Including accurate and professional contact details

- Crafting a compelling career summary

- Detailing relevant financial advising experience

- Highlighting key skills essential for financial advising

- Showcasing education and certifications important for Financial Advisors

- Choosing an effective resume layout and design

Let’s get started!

Resume example (text format)

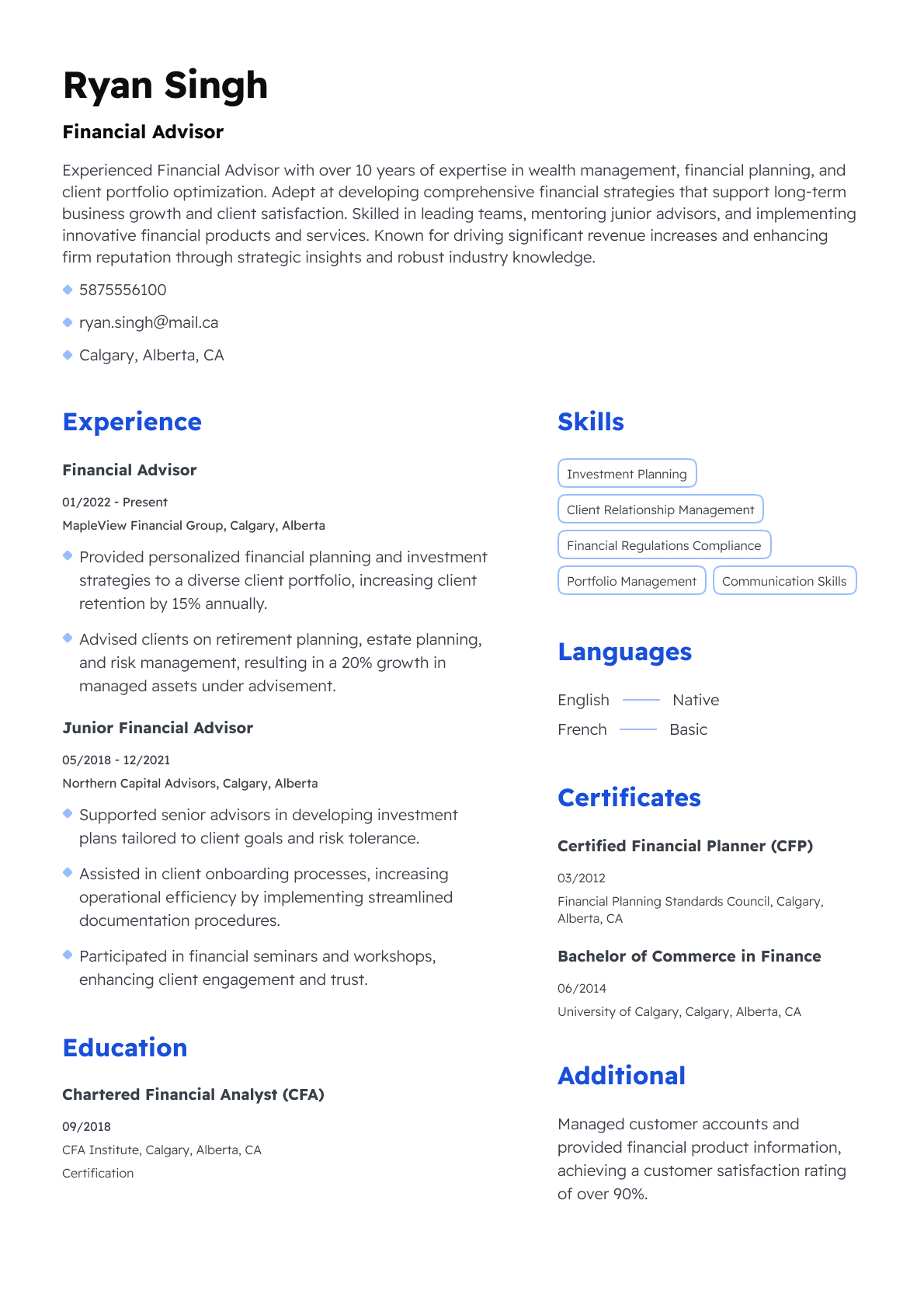

Ryan Singh

Financial Advisor

ryan.singh@mail.ca 5875556100 Calgary, Alberta, CA

Profile

Experienced Financial Advisor with over 10 years of expertise in wealth management, financial planning, and client portfolio optimization. Adept at developing comprehensive financial strategies that support long-term business growth and client satisfaction. Skilled in leading teams, mentoring junior advisors, and implementing innovative financial products and services. Known for driving significant revenue increases and enhancing firm reputation through strategic insights and robust industry knowledge.

Work Experience

01/2022 - Present, Financial Advisor, MapleView Financial Group, Calgary, Alberta

- Provided personalized financial planning and investment strategies to a diverse client portfolio, increasing client retention by 15% annually.

- Advised clients on retirement planning, estate planning, and risk management, resulting in a 20% growth in managed assets under advisement.

- Conducted market research and analysis to identify suitable investment opportunities and optimize portfolio performance.

05/2018 - 12/2021, Junior Financial Advisor, Northern Capital Advisors, Calgary, Alberta

- Supported senior advisors in developing investment plans tailored to client goals and risk tolerance.

- Assisted in client onboarding processes, increasing operational efficiency by implementing streamlined documentation procedures.

- Participated in financial seminars and workshops, enhancing client engagement and trust.

06/2015 - 04/2018, Financial Services Assistant, GreenTree Bank, Calgary, Alberta

- Managed customer accounts and provided financial product information, achieving a customer satisfaction rating of over 90%.

- Supported financial advisors with administrative tasks and client follow-ups, ensuring compliance with banking regulations.

- Developed knowledge of financial products, leading to recommendation of suitable solutions to clients.

Education

09/2018, Chartered Financial Analyst (CFA), CFA Institute, Calgary, Alberta, CA

06/2014, Bachelor of Commerce in Finance, University of Calgary, Calgary, Alberta, CA

03/2012, Certified Financial Planner (CFP), Financial Planning Standards Council, Calgary, Alberta, CA

Skills

- Investment Planning

- Client Relationship Management

- Financial Regulations Compliance

- Portfolio Management

- Communication Skills

How to write a Financial Advisor resume

Before beginning, it’s essential to understand what information your Financial Advisor resume must include. Key sections typically are:

- Professional Profile

- Relevant Work Experience

- Education and Certifications

- Core Skills

Your resume should clearly communicate the unique value you bring as a Financial Advisor. Start by researching the company and the role to align your experience with their needs. Design your resume to demonstrate that you are the ideal advisor to help clients achieve financial goals. To craft a strong resume, follow these guidelines:

- Emphasize your achievements and impact, instead of just listing job duties. Show measurable results that highlight your effectiveness.

- Customize your resume’s style and language for each application to reflect the employer’s culture and priorities.

- Present a polished and professional image using a clean, streamlined resume template that is easy to read.

- Incorporate relevant keywords from job descriptions to ensure your resume is optimized for both human reviewers and applicant tracking systems.

Choosing the right resume format for Financial Advisors

Your resume should be clear, professional, and logically organized—qualities that mirror the trustworthiness of a successful Financial Advisor.

The reverse chronological resume format is typically the most effective. It highlights your most recent roles first and then works backwards, showcasing your career progression.

If you are transitioning careers or have a diverse background, a functional format focusing on skills and achievements might be more appropriate. Alternatively, a hybrid format combining chronological and functional elements can also work well.

Explore different resume templates in our resume builder and select the format that best portrays your professional story. Professional and modern layouts will strengthen your Financial Advisor personal brand.

Include your contact information

The header of your resume is your chance to immediately communicate who you are and how you can be reached. It should be easily accessible and presented with professionalism.

Include the following details:

- Your full name

- Your professional email address

- Your phone number

- Your LinkedIn profile URL (if applicable)

Avoid including:

- Your full home address

- Irrelevant personal information

Crafting an engaging summary

Financial advising is a blend of analytical skill and interpersonal insight. Your resume summary (also known as a profile) is the ideal section to convey both your expertise and your personable approach. This is your opportunity to break away from the stereotype of financial professionals as impersonal and highlight the human side of your advisory skills.

Think of your summary as a brief narrative showcasing your professional strengths and your character. Unlike other parts of the resume, this section allows for more creativity and an expressive tone.

Use energetic, action-oriented language and positive statements to let your personality shine through. Avoid simply restating your resume content; instead, provide insight into your work philosophy and noteworthy accomplishments.

Below are adaptable sample summaries suitable for various levels of experience:

Entry-level adaptable resume summary/profile example

Mid-level adaptable resume summary/profile example

Senior adaptable resume summary/profile example

Present your Financial Advisor work experience

Following a reverse chronological order, list your most recent or current role at the top, working backward to previous positions. Limit experience to the last 10-15 years to maintain relevance.

Focus on roles directly related to financial advising. If you have unrelated work history you'd like to share, consider adding an additional section for "Other Experience."

For each job entry, include your title, employer, and dates, followed by detailed bullet points describing your responsibilities and, importantly, your accomplishments. Start each point with a strong action verb, avoiding pronouns.

Go beyond duties—highlight quantifiable results and the value you added. Without specifics, your experience may appear generic and uninspiring.

Examples of weak bullet points anyone could write include:

- Provided financial planning services to clients

- Assisted clients with investment options

- Prepared financial reports and recommendations

By adding specificity and impact, those bullets improve dramatically:

- Advised a portfolio of 50+ high-net-worth clients, increasing assets under management by 20% within one year

- Developed personalized investment strategies that achieved an average annual return of 8% above market benchmarks

- Streamlined client reporting processes, reducing turnaround time by 30% and improving satisfaction ratings

Below is an example of a Financial Advisor’s employment history section:

Financial Advisor employment history resume sample

01/2022 - Present, Financial Advisor, MapleView Financial Group, Calgary, Alberta

- Provided personalized financial planning and investment strategies to a diverse client portfolio, increasing client retention by 15% annually.

- Advised clients on retirement planning, estate planning, and risk management, resulting in a 20% growth in managed assets under advisement.

- Conducted market research and analysis to identify suitable investment opportunities and optimize portfolio performance.

05/2018 - 12/2021, Junior Financial Advisor, Northern Capital Advisors, Calgary, Alberta

- Supported senior advisors in developing investment plans tailored to client goals and risk tolerance.

- Assisted in client onboarding processes, increasing operational efficiency by implementing streamlined documentation procedures.

- Participated in financial seminars and workshops, enhancing client engagement and trust.

06/2015 - 04/2018, Financial Services Assistant, GreenTree Bank, Calgary, Alberta

- Managed customer accounts and provided financial product information, achieving a customer satisfaction rating of over 90%.

- Supported financial advisors with administrative tasks and client follow-ups, ensuring compliance with banking regulations.

- Developed knowledge of financial products, leading to recommendation of suitable solutions to clients.

Showcase key skills relevant to Financial Advisors

Financial advising requires a blend of technical expertise and interpersonal abilities. Your resume should reflect a balance of hard skills—such as proficiency with financial software, portfolio management, and regulatory knowledge—and soft skills like communication, client relationship management, and problem-solving.

Keep your skills section focused and concise, tailoring it to the specific financial advisory role you want. Maintain a master list of your competencies and select the most impactful ones based on job descriptions.

Our resume builder provides a selection of pre-written skills to choose from, but you can also add your unique talents.

Here’s how the skills section might appear in a Financial Advisor resume template:

Financial Advisor key skills resume sample

- Investment Planning

- Client Relationship Management

- Financial Regulations Compliance

- Portfolio Management

- Communication Skills

Highlight your education & certifications

Include academic qualifications that establish your foundation as a Financial Advisor. Most professionals hold degrees in finance, economics, business administration, or related fields.

Beyond degrees, certifications play a crucial role in establishing credibility and expertise. Consider including:

- Certifications like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS)

- Relevant licenses such as Series 7, Series 65, or Series 66

- Professional development courses and memberships in financial associations

- Internships or apprenticeships for those new to the field

Financial Advisor education & certifications resume sample

09/2018, Chartered Financial Analyst (CFA), CFA Institute, Calgary, Alberta, CA

06/2014, Bachelor of Commerce in Finance, University of Calgary, Calgary, Alberta, CA

03/2012, Certified Financial Planner (CFP), Financial Planning Standards Council, Calgary, Alberta, CA

Choosing an effective resume layout and design

The right layout and design can significantly impact how a hiring manager perceives your Financial Advisor resume. These elements work together to focus attention on your qualifications and professionalism.

A clean and classic design is ideal for Financial Advisors, reflecting reliability, precision, and trustworthiness. Your resume should be easy to read and free of clutter.

Consider what your template communicates about you. For most financial advising roles, simple and elegant layouts are preferable, though some employers appreciate a modern touch.

Browse our tested resume templates to find formats that save you time and present your credentials effectively.

Financial Advisor job market and outlook

The need for skilled Financial Advisors remains strong and is anticipated to grow by about 14% from 2021 to 2031 according to the U.S. Bureau of Labor Statistics. This growth outpaces the average for all occupations.

Rising demand for comprehensive financial planning and wealth management services is driving this trend, as individuals and businesses seek expert guidance to meet complex financial goals.

The median annual salary for Financial Advisors is approximately $89,000, with top earners making well over $180,000 per year.

Overall, the job market outlook for Financial Advisors is positive, with robust opportunities expected in the coming decade.

Key takeaways

Financial advising is a growing field with excellent prospects. The projected job growth rate of 14% through 2031 highlights strong demand for skilled professionals.

Clients increasingly rely on expert advisors to navigate financial markets and plan their futures, driving sustained need for Financial Advisors.

The median salary is competitive, with top performers earning substantial incomes.

By crafting a tailored, achievement-focused resume, you can position yourself as a standout candidate in this competitive landscape.

Use strategic formatting, clear communication, and relevant keywords to maximize your resume’s impact and secure your next Financial Advisor role.